Protect your family’s finances if something catastrophic happens.

Life Insurance is pretty straightforward. If something happens to you, the policy pays your beneficiary(ies) the amount of coverage that was purchased. The most common use of life insurance is to replace lost income due to the death of a spouse or caretaker. Additionally, this payment is typically tax free which is an often overlooked benefit.

The need for life insurance is well understood, so why do people put off buying it?

Many people hit a mental roadblock when buying life insurance, and usually it’s because of the expected cost and/or the process of getting coverage.

Many people assume that life insurance costs 3-4 times what it actually costs. This is a problem, as it prevents people from acting when they should.

- Term life insurance is typically the most affordable coverage, and the simplest to purchase.

As agents, we want to simplify the process so our clients get the coverage they need.

- We work with several highly rated life insurance companies that require no more than answering 10-15 health questions. This helps to reduce the burden our clients encounter during the underwriting process and enables more people to get the coverage they need without the hassle.

You cant buy flood insurance when the water is rising.

However, a chronic health condition doesn’t mean you can’t get affordable life insurance. Many people we help have chronic illnesses and need life insurance coverage just like anyone else. If you have a chronic illness such as diabetes, or high blood pressure, please know that you can likely get coverage. There may be a couple of additional requirements, but most companies simply want to know that the individual they are working with actively manages their condition.

The best time to buy life insurance is now.

The fact is, the rates you will qualify for now, are not likely to be seen again. Naturally, as you age the cost increases.

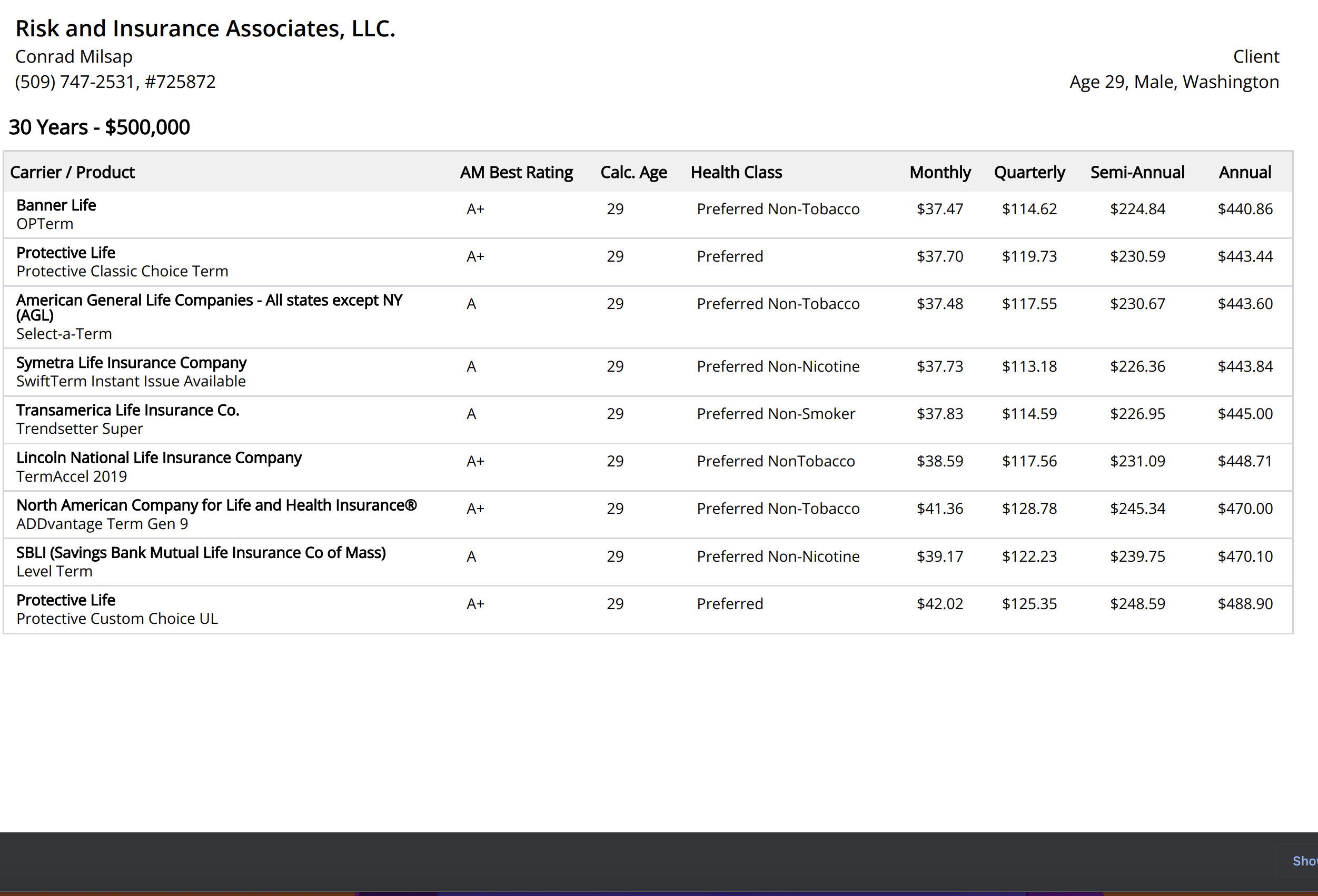

To illustrate the advantage of securing coverage earlier than later in life, here is an example of a policy we recently wrote for a client.

A$500,000, 30 year term life insurance policy on a 29 year old male in Washington for under $40 per month..